Explanation 1.- A supply of goods and/or services in the course of import into the territory of India shall be deemed to be a supply of goods and/or services in the course of inter-State trade or commerce. Explanation 2. – An export of goods and/or services shall be deemed to be a supply of goods and/or services in the course of inter-State trade or commerce. Important Files

Clause by Clause Analysis for IGST BillIGST Bill, Download Integrated IGST BillDraft IGST Law, Integrated IGST Law in PDF FormatList of all sections of IGST, All Sections Integrated GST

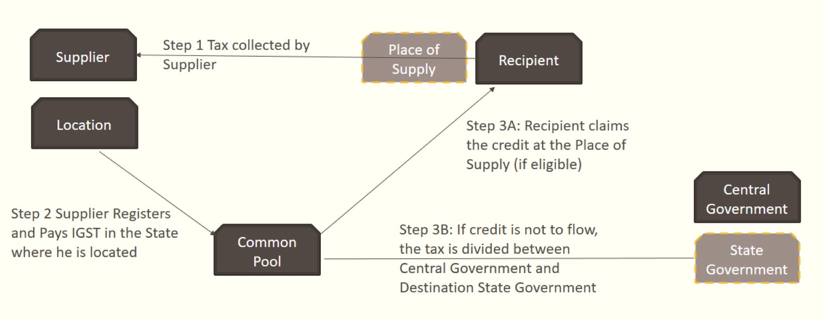

IGST – How it is works?

What is IGST?

The IGST Act comprises of the following:

9 Chapters25 Sections8 Definitions

A BILL to make a provision for levy and collection of tax on inter-State supply of goods or services or both by the Central Government and for matters connected therewith or incidental thereto. This legislation is called the integrated Goods and Services Tax Act, 2017 (in short IGST), an Act to levy, collect and administer IGST in India. This Act shall be applicable to whole of India, i.e., including the State of Jammu & Kashmir. Presently, Service Tax does not apply to State of Jammu & Kashmir but Central Excise Act, 1944 applies to that state. What is meant by ‘India’ is defined in section 2(35) of Goods and Services Tax Act, 2016. The Act after being legislated shall come into force from a date which will be notified by the Central Government by way of a notification. It may also appoint different dates for enforcement of different provisions of the Act. IGST or integrated goods and services tax would mean the tax levied under IGST Act on the supply of any goods and / or services in the course of inter-state trade or commerce. ‘Goods’ and ‘services’ are defined in the Constitution of India itself vide 122nd Amendment. CGST Act in its section 2(50) also defines IGST as tax levied under the IGST Act. IGST shall also apply to import of goods and services into India. The explanation stipulates that any supply of goods or services in the course of import of goods or services into Indian territory shall be deemed to be supply of goods / services in the course of inter-state trade or commerce and hence liable the IGST. It has also been proposed that like import transactions, export of goods and services shall be deemed to be supply in course of inter-state trade or commence. Interstate trade or commerce will, therefore include supply of goods / services in the course of –

Inter-state trade or commenceImport into Indian territory (deemed to be inter-state)Export (deemed to be inter-state)

Thus, IGST shall apply to inter-state transactions and import as well as export transactions (deemed to be inter-state transactions) relating to supply of goods and / or services. Presently, article 269 of the Constitution empowers the Parliament to make law on the taxes to be levied on the sale or purchase taking place in the course of inter-State trade or commerce. Accordingly, Parliament had enacted the Central Sales Tax Act, 1956 for levy of central sales tax on the sale taking place in the course of inter-State trade or commerce. The central sales tax is being collected and retained by the exporting States. In view of the above, it has become necessary to have a Central legislation, namely, the Integrated Goods and Services Tax Bill, 2017. The proposed Legislation will confer power upon the Central Government for levying goods and services tax on the supply of goods or services or both which takes place in the course of inter-State trade or commerce. The proposed Legislation will remove both the lacunas of the present central sales tax. Besides being vatable, the rate of tax for the integrated goods and services tax is proposed to be more or less equal to the sum total of the central goods and services tax and state goods and services tax or Union territory goods and services tax to be levied on intra-State supplies. It is expected to reduce cost of production and inflation in the economy, thereby making the Indian trade and industry more competitive, domestically as well as internationally. It is also expected that introduction of the integrated goods and services tax will foster a common or seamless Indian market and contribute significantly to the growth of the economy. If you have any query regarding “What is IGST – Integrated GST (Integrated Goods and Services Tax)” then please tell us via below comment box…