Internal Rate of Return

Before undertaking a particular project, we need to analyze it from various angels. One of such techniques is Net Present Value that we had seen earlier. Another Important technique is by calculating the Internal Rate of Return. Let us understand what Internal Rate of Return is & how is it calculated & analyzed.

What is IRR?

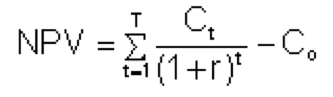

For details on NPV & PI, please refer my articles : NPV – Click Here PI – profitability index Now, let us have a look on how Internal Rate of Return is calculated. This is the formula for calculating NPV: where: Ct = net cash inflow during the period t Co= total initial investment costs r = discount rate, and t = number of time periods As it will be required to be calculated through a computer application because of the complex nature of the formula, it is generally calculated with the help of trial & error method. By using the trial & error method, you can use approximate rates & ascertain the NPV at that rate. A better idea would be to use two rates which have a good difference between them. So, you can understand the rate which is nearer to the required rate & then you can proceed accordingly. There are various advantages & disadvantages of IRR. Let us have a look on them.

Advantages

Simple As seen above, Internal Rate of Return is easy to calculate. There is no such hard & fast formula & can be easily calculated by a layman as well. Gives Importance To The Time Value Of Money While other methods don’t consider effects of inflation, deflation, etc., Internal Rate of Return method gives due importance to the effect of time value of money. It considers the change in the value of rupee. Thus it indicates a true picture of the scenario. But is also accompanied by various disadvantages.

Let us have a look on the disadvantages:

Reinvestment Aspect Is Not Considered : There are various projects which require investment not just in the initial phase, but also over the life. IRR is unusable in such cases. Only the projects which require just one time initial outlay can be analyzed under this method. Also, future costs are not considered in this method. Size Of The Project Is Not Considered: If different projects have different project size, the IRR method will not suffice. This can be troublesome when two projects require a very different amount of capital out flow, but the smaller project returns a higher IRR. This would turn out to be an inappropriate method in such a case. Thus, IRR is an excellent way to find the project with higher returns. The project having higher IRR is generally the better project. Recommended Articles

Accrued LiabilitiesAccounting Standard 15Various Types of Vouchers In AccountingSubsidiary Books And Their AdvantagesAccounting for Not for Profit Organisation