Is this transport service taxable ? if yes at what rate Is the transport service is under reverse charge?What is clear status of transport of goods by road service other than GTA.

First of all one has to establish what is transport of goods by road service other than GTA so that it can be dealt in GST.

GST on Transport of Goods by Road Service

First of all Establish that what is GTA

What is Goods Transport Agency under service tax ; Under Service Tax As per Section 65B (26) of the Finance Act, 1994; “Goods Transport Agency means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called”. Therefore, in the Service Tax regime, issuance of Consignment Note was integral and mandatory requirement before any road transporter could be brought within the ambit of GTA. Under GST GTA has not been defined in the CGST Act,2017. As per Notification No. 12/ 2017 of CGST Rate dated 28.06.2017 under 2 (ze) explain the GTA as “ Goods transport agency” means any person who provide service in relation to transport of goods by road and issues consignment note , by whatever named called; It means that if consignment note is issued in relation to transport of goods by road ,it will fall under the GTA service . If consignment note is not issued , supplier of service will not fall under the ambit of GTA. Therefore, limb which is important here is Consignment note. Therefore any owner of transport who does not issue consignment note is not covered by the GTA . It means ,service provided by individual transporter or tempo owner if they do not issue consignment note is outside the ambit of GTA.

What is Consignment Note

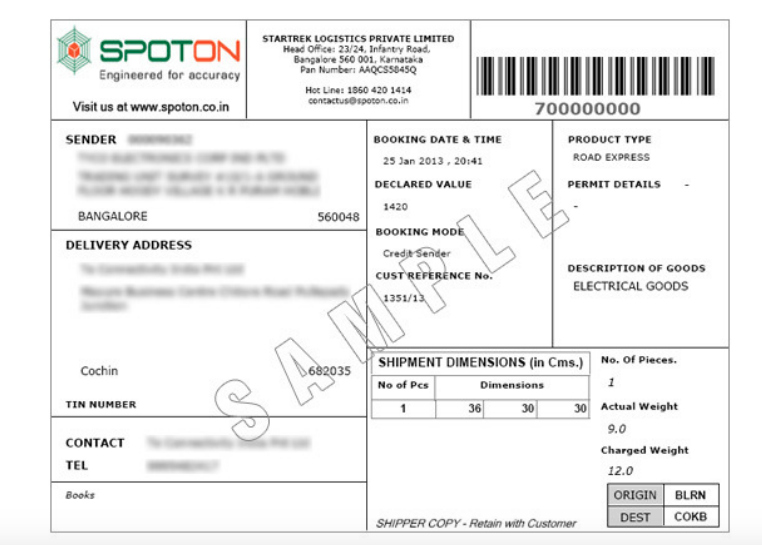

Consignment note has not been defined anywhere in GST law. As per Rule 4B of the Service Tax Rules,1994, consignment note means a document, issued by a goods transport agency against the receipt of goods for the purpose of transport of goods by road in a goods carriage, which is serially numbered, and contains the name of the consignor and consignee, registration number of the goods carriage in which the goods are transported, details of the goods transported, details of the place of origin and destination, person liable for paying service tax whether consignor, consignee or the goods transport agency.

What are the important ingredients of consignment note

SAMPLE OF CONSIGNMENT NOTE

Is the transport of goods Service Taxable In terms of Notification no. 12/2017-Central Tax (Rate) dated 28.06.2017 (Sr. No.18), the following services are exempt from GST. Services by way of transportation of goods (Heading 9965): (a) by road except the services of:

(i) a goods transportation agency;(ii) a courier agency;

(b) by inland waterways. Thus, it is inferred from the above notification that mere transportation of goods by road, unless it is a service rendered by a GTA , is exempt from GST. Therefore , transport of goods by road is exempt under GST Act.

Is the transport of goods by road [ other than GTA] is under reverse charge

Transport of goods by road [ other than GTA ] is not under reverse charges . Moreover this does not fall under Section 9[3] or 9[4] of the CGST Act,2017 or Section 5[3] and 5[4] of the IGST Act,2017. Why it can not be taxed under section 9[4] of the CGST Act,2017 or 5[4] of the IGST Act. If registered dealer take service of transporter [other than GTA] who is unregistered dealer then why the same can not be taxed under section 9[4] of the CGST Act,2017. Simple reason of the same is transport service other than GTA is exempt from tax therefore it will not taxed under reverse charge as well.

What is the clear Status of Transport of goods by road Other than GTA [CONCLUSION]

From the above forgoing discussion we had extracted and established that transport of goods on road service is exempted from GST. Hence GST shall not be applicable. Individual truck/tempo operators who do not issue any consignment note are not covered within the meaning of the term GTA. As a corollary, the services provided by such individual transporters who do not issue a consignment note will be covered by the entry at S.No.18 of notification no.12/2017-Central Tax (Rate), which is exempt from GST. Author – CA. Sanjeev Singhal Recommended Articles

GST RegistrationGST FormsGST RatesGST LoginGST Due Dates