Earnings per share (EPS) is an important measure of the performance of the company. The equity shareholders (ordinary shareholders as per Ind AS 33) invest their money in the entity as owners of the company. They undertake business risks and financial risks along with all allied systematic and non-systematic risks of the company. Generally, they would expect a higher return as compared to a debt-holder considering the risks involved on their investments.

Formula

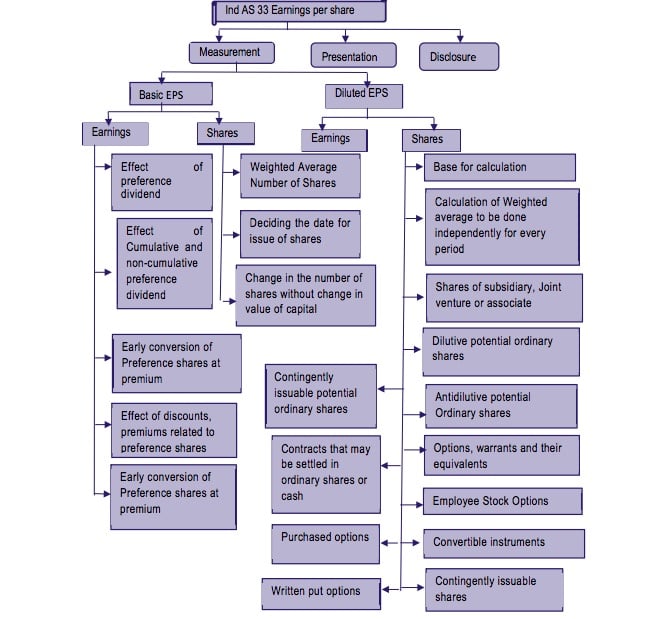

Basic earnings per share shall be calculated by dividing profit or loss for the periodattributable to ordinary equity holders of the parent entity (the numerator) by the weightedaverage number of ordinary (equity) shares outstanding during the period (the denominator).It can be expressed mathematically as follows: OR

Calculated using

When calculating, it is more accurate to use a weighted average number of shares outstanding over the reporting term, because the number of shares outstanding can change over time. However, data sources sometimes simplify the calculation by using the number of shares outstanding at the end of the period. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-earnings ratio. An important aspect of EPS that’s often ignored is the capital that is required to generate the earnings (net income) in the calculation. Two companies could generate the same EPS number, but one could do so with less equity (investment) – that company would be more efficient at using its capital to generate income and, all other things being equal, would be a “better” company. Investors also need to be aware of earnings manipulation that will affect the quality of the earnings number. It is important not to rely on any one financial measure, but to use it in conjunction with statement analysis and other measures.

Basic earnings per share

Basic earnings per share shall be calculated by dividing profit or loss attributable to ordinary equity holders of the parent entity (the numerator) by the weighted average number of ordinary shares outstanding (the denominator) during the period. For the purpose of calculating basic earnings per share, the amounts attributable to ordinary equity holders of the parent entity in respect of:

(a) profit or loss from continuing operations attributable to the parent entity; and(b) profit or loss attributable to the parent entity

shall be the amounts in (a) and (b) adjusted for the after-tax amounts of preference dividends, differences arising on the settlement of preference shares, and other similar effects of preference shares classified as equity. Where any item of income or expense which is otherwise required to be recognised in profit or loss in accordance with Indian Accounting Standards is debited or credited to securities premium account/other reserves, the amount in respect thereof shall be deducted from profit or loss from continuing operations for the purpose of calculating basic earnings per share. For the purpose of calculating basic earnings per share, the number of ordinary shares shall be the weighted average number of ordinary shares outstanding during the period. The weighted average number of ordinary shares outstanding during the period and for all periods presented shall be adjusted for events, other than the conversion of potential ordinary shares that have changed the number of ordinary shares outstanding without a corresponding change in resources.