Principal ⇒ Agent [ Contractual Agreement – written / oral / merely inferred from the way an agent and its principal conduct their business affairs]

Conditions for Agents under GST:

Agreement must be explicit to show that an agent is arranging the transactions on behalf of its principal, rather than trading on its own account;Agent must not be the owner of any of the goods, or use any of the services which they procure / avail for making outward supplies on behalf of its principal;No alteration either in the nature or value of any of the supplies made between principal and third parties

Agents and their Liabilities

(i) Acting on behalf of the Principals(ii) Acting in their own name(iii) Importing goods on behalf of a non-taxable person in India(iv) Acting on behalf of a person having no place in India

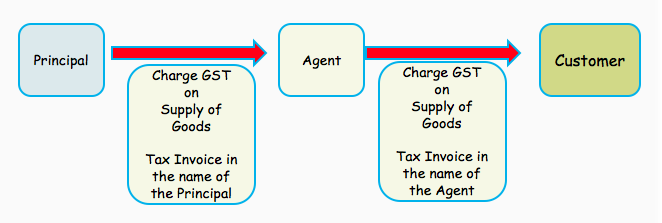

(i) Agents – Acting on behalf of the Principals, may

Receive or deliver goods;Hold stock of goods for his principal; orMake or receive payment

Conditions :

The supply is between the principal and the customerTax invoice must be issued by the principal for the supply that he made to his customerIf the agent is a registered person, he must also issue a tax invoice for the supply of services that he made to his principal

X Ltd. (Principal), a GST registered Taxable Person, engages Mr.B, a GST registered taxable person, as an agent to sell its products. The products were sold for Rs.10 lacs. Commission @ 10%. GST rate @ 28 (on goods) and @18% ( on services).

Activities:

X Ltd. will levy GST @ 28% on Outward Supplies ( of goods) of Rs.10 lacs.Mr. B will levy GST @ 18% on Outward Supplies ( of services) on Rs.(10 lacs x 10% x 18%).X Ltd. will claim Input Tax Credit on GST paid on Commission to Mr.B.

(ii) Agents – Acting in their own name

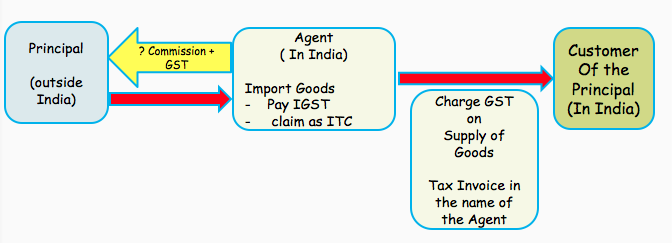

(iii)(a) Agents – importing goods on behalf of a non-taxable person

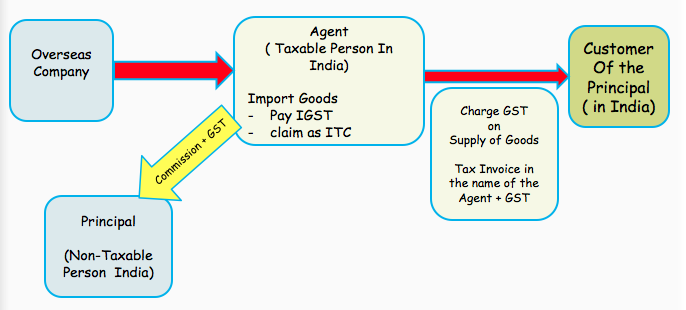

(iii)(b)Agents – importing goods on behalf of a non-taxable person

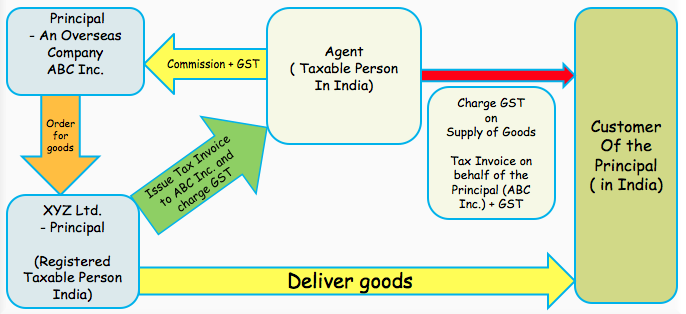

(iv) Agents – acting behalf of persons having no place in India

Registration must be made through an agent, having a registered place of business in IndiaGST registration in the name of the overseas principal and not in the name of the appointed agentAgent would be responsible for liabilities under GSTAgent may represent more than one Principal

Recommended Articles

GST ScopeGST ReturnGST FormsGST RateGST RegistrationWhat is GST?GST Invoice FormatGST Composition SchemeHSN CodeGST LoginGST RulesGST StatusTrack GST ARNTime of Supply